Project: Pricing market research

At this point, all that’s left to do with your survey/interview is finalize it, ship it, analyze the results, and act on them.

You could do that now. We’ve provided those four steps below, in case you need to set a pricing structure ASAP.

But if you have time, we recommend finishing this module before shipping your survey. Other than the next page—where we’ll go over calculating unit economics—the rest of this module gets more theoretical, and more strategic. We’ll explore how your business model fits with your market, product, and channel. It’s a chance to carefully consider your startup’s unique opportunities and limitations in relation to your business model.

Based on those readings, you might reach some new conclusions about the pricing strategy that’s best for you.

Step 1: Finalize your questions

Take a look at your project doc. Pull together all the questions you have for customers, which by now could include questions about:

- Value metrics / proxies

- Pricing structure

- Willingness to pay (the four Van Westendorp questions)

- Bonus tactics covered on the previous page, such as freemium and incentives

Are there any other questions that are important for your product or service? Although you should aim to keep your survey short, add any further questions that you think will help you home in on the right pricing strategy for your startup. Some examples might be:

- Do you use a product/service for [your product’s JTBD]?

- If so, what do you use? What would cause you to explore different solutions?

- If not, are you interested in a product/service for [your product’s JTBD]? Why?

- [For B2B], what’s your team’s budget for this kind of product/service?

- Which of these value propositions are most/least important to you?

Step 2: Prep and start your survey or interviews

Decide how you want to ask your questions. You can either:

- Send out a survey. We recommend using SurveyKing. It has helpful features for analyzing some of the trickier components of pricing data.

- Talk to customers/prospects over phone or video calls.

Which one should you do? Here’s a framework for determining whether to go the survey or interview route:

- If you think you can get at least 100 survey responses, we recommend conducting a survey. Surveys allow you to be more rigorous with your data, particularly when it comes to value metrics.

- If you don’t think you can get at least 100 survey responses, we recommend customer interviews. Aim for at least ten. Obviously, the more you have, the more data you’ll collect—but anything is better than zero.

Guidelines for surveys

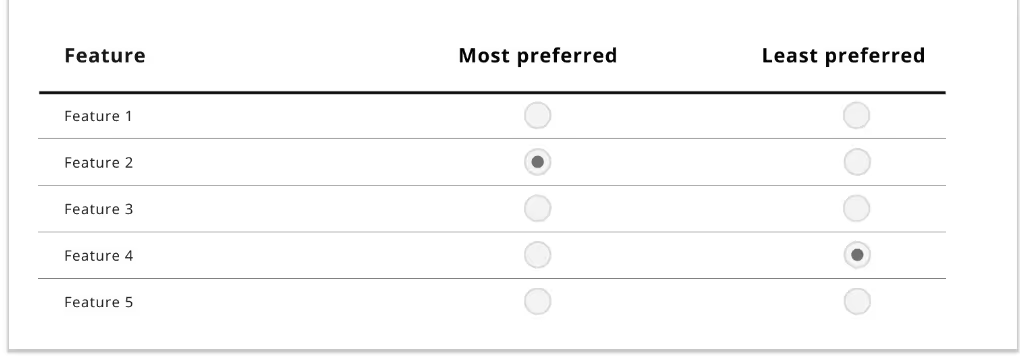

1. Use the max-differential method to pick your value metric. The max-diff method is a technique for determining the relative priorities of different metrics/proxies. It’s a simple way to reveal what your power features are.

Instead of asking customers to provide ratings on a numerical (e.g., 1-10) scale, you ask which features they value most and least.

Max-diff is complicated to set up and analyze, which is why we recommend using a survey platform that has built-in max-diff tools, like SurveyKing. You’ll use a series of sets with a “most” and “least” layout—it will look something like this:

Once you have your survey software in place, go ahead and turn your value metric proxies into features. For instance, for our language-learning app, we’ll convert our proxies “live classes taken” and “quizzes taken” into “live classes” and “quizzes.”

Then follow the steps in your survey platform to apply the max-diff method to them.

SurveyKing has a helpful explanation of max-diff, in case you’d like to dig deeper into it before building your survey.

2. Offer price ranges for your willingness-to-pay (Van Westendorp) questions. That way, you won’t get prices that are wildly off from what you would ever consider implementing. One option is to use sliders:

3. Test your survey before shipping it. Have colleagues from different teams go through the survey to make sure it’s clear, logical, and easy to complete.

Guidelines for interviews

If you’re conducting interviews instead of surveys, you won’t be doing rigorous max-diff analysis. But you should still ask value metric questions—just ask interviewees what their favorite and least favorite product features are. You can ask the four Van Westendorp questions too.

1. Keep interviews short and informal. Don’t approach this like a job interview. You want interviewees to be comfortable and candid.

2. With permission, record your interviews. That way, you can refer back to the conversations later and share them with your team.

3. Keep your conversation in the real world. What we mean by that: Avoid hypotheticals. You want to know what customers would actually do, not what they say they’d do. While there will always be a say-do gap, you can minimize it by keeping questions to actual situations and not imagined ones. E.g., instead of asking if someone would use X feature, ask if they have.

Step 3: Collect your results

Use your survey software to collect and assess the results.

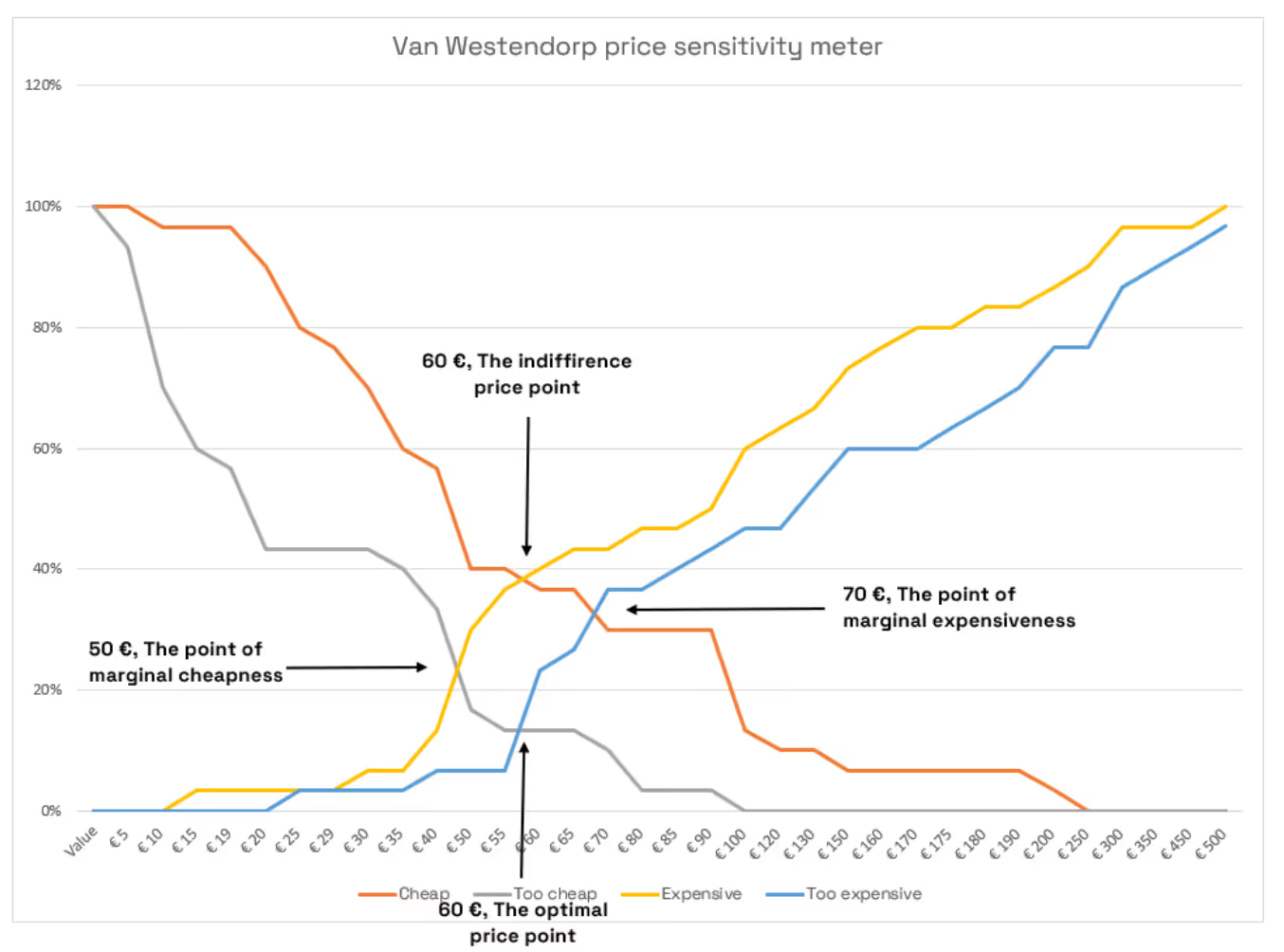

Your four Van Westendorp questions will require special analysis. Marketing strategist Matej Lupták put together a great step-by-step guide for Van Westendorp analysis: “A Complete Guide to Van Westendorp + How to Graph It in Excel.”

We recommend following the steps he provides. Once you do, you’ll have a graph that shows you your range of acceptable prices.

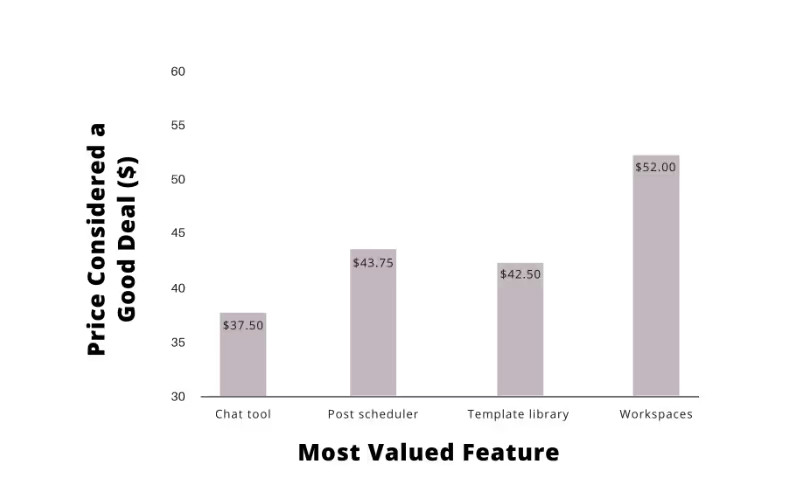

Bonus: Segmentation

When you have your Van Westendorp graph, you can use segmentation to narrow your range down even further. Go back to your survey/interview responses and segment them. For instance, you could map out feature preferences vs. willingness-to-pay responses to see if certain features are what people are willing to pay (or pay more) for.

We recommend segmenting your findings by customer persona too, to see how your willingness-to-pay data maps onto different personas. B2C companies could compare willingness to pay across different persona traits, like annual household income or age. B2B companies will want to look at criteria such as company size, industry, and/or job title to determine how personas might align with pricing (and tiers if applicable).

(If you implement those findings, be mindful of not upsetting any persona groups. Tinder had to settle a class action lawsuit that accused them of age discrimination—they were charging older users more.)

Advanced tip: If you’re selling beyond a regional market, see what happens when you segment your results by location. Because of different demand and currencies, it’s very likely that you’ll see markedly different results. That’s presumably why Netflix charges different prices depending on where you’re watching, from $3/month in Turkey for a standard subscription (as of January 2022), to $20.46/month in Liechtenstein.

Step 4: Act on your results

Now that you’ve done the research and collected the data, use a combination of your findings and qualitative reasoning to reach your price.

One last thing: Update your customer personas based on your survey/interview findings. Add:

- Most and least valued features

- Willingness-to-pay data (e.g., what they think is an acceptable price)

- Any new insights gained: learnings about needs, behaviors, value props that resonate, etc.

Pricing conclusion

That’s a wrap on pricing basics! But before we move on to unit economics and business model fits, two quick reiterations. If you take only two points away from this reading, make these them:

Talk to customers. Listen to them. Find out what serves them best, according to them. Pay attention to feedback from your sales team. Conduct social listening. Knowing what your market wants is a vastly more effective approach to pricing than blind guessing.

Continuously optimize. Everything in the startup world is always changing. Your pricing strategy should too. Use new findings to make new decisions. If you decide to raise prices, use your market research to understand what users are paying for—e.g., specific features or tools. Make sure your price increase aligns with that value.

Those two points are closely related. At the early-startup stage, optimizing means iterating based on customer research. Later, when your startup has more data, experience, and infrastructure, you’ll be able to transition to a more scientific approach to pricing—one that uses rigorous A/B testing rather than qualitative customer research.

But for now, your best resource for pricing decisions is the people your product was built for.

Next up: calculating ARPU and CAC.