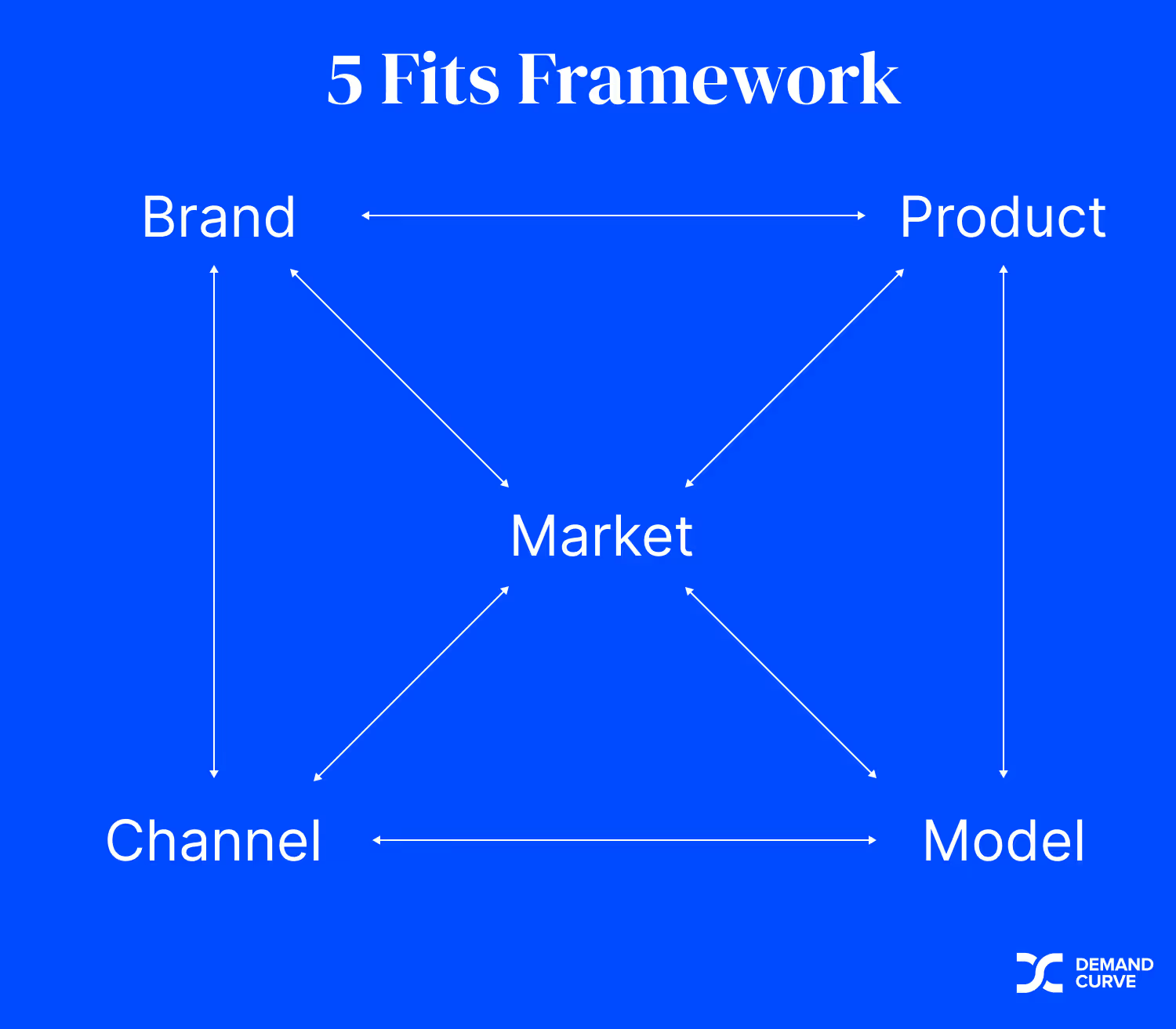

The Five Fits Framework

Growth isn't just about marketing channels, conversion rate optimization, or any other stand-alone function. Growth is holistic—it comes when the individual parts of your startup are working together, in harmony.

This is easier said than done. That's why we use something called the Five Fits Framework to map exactly how the different components of a company "fit" together to drive (or hinder) growth.

Founders are often floored by how powerful this framework is for decision making. The Five Fits Framework allows you to:

- Figure out how your startup will grow.

- Skip months or years of trial and error by investing in the right strategy early on.

- Reverse-engineer how competitors and other companies grow (and see why some are able to grow and others aren't).

- Identify when, why, and if you should make a change within your startup, and how to run experiments with purpose.

Your foundational fits will set you up for success or failure down the road.

It won't matter how hard you work or how clever your tactics are. If your fits are broken, growth will be incredibly hard.

What is the Five Fits Framework?

You've probably heard of the concept of "product-market fit": when your product aligns with the needs of a market. You may even be familiar with the concept of "channel-product fit": when the channel you use to acquire customers works well with the product you're selling. These are two examples of "fits."

The team at ed-tech company Reforge took these concepts a step further by explaining that there are four fits that determine the growth potential of a product. We've built on their framework and added a fifth component (brand). Here are all five:

- Your market: whom you choose to serve

- Your product: what you sell

- Your business model: how you make money

- Your brand: how you present yourself to your market and the world

- Your acquisition channel: how you get new customers

Each component has a direct relationship with the others.

For example, you might have the best product, wealthiest market, most attractive brand, and highest-margin business model. But if you can't figure out a way to consistently and repeatedly acquire new customers, your startup will likely fail.

We use the term "fit" to describe the relationship between each of the five key components.

Let's take a look at how the five fits work together.

In the rest of this article, we’ll go through how market relates to each of the other four components. We’ll look at how market fits with product (Market-Product Fit), model (Market-Model Fit), brand (Market-Brand Fit), and channel (Market-Channel Fit). We’ll then consider the relationships between product and channel (Product-Channel Fit) and model and channel (Model-Channel Fit). Each fit relationship is a testament to just how intertwined marketing is with every other element of your business and its ecosystem. Any fit that’s not a strong one reduces the chances of growth and success.

Market-product fit

Definition: how your market fits with the product you sell

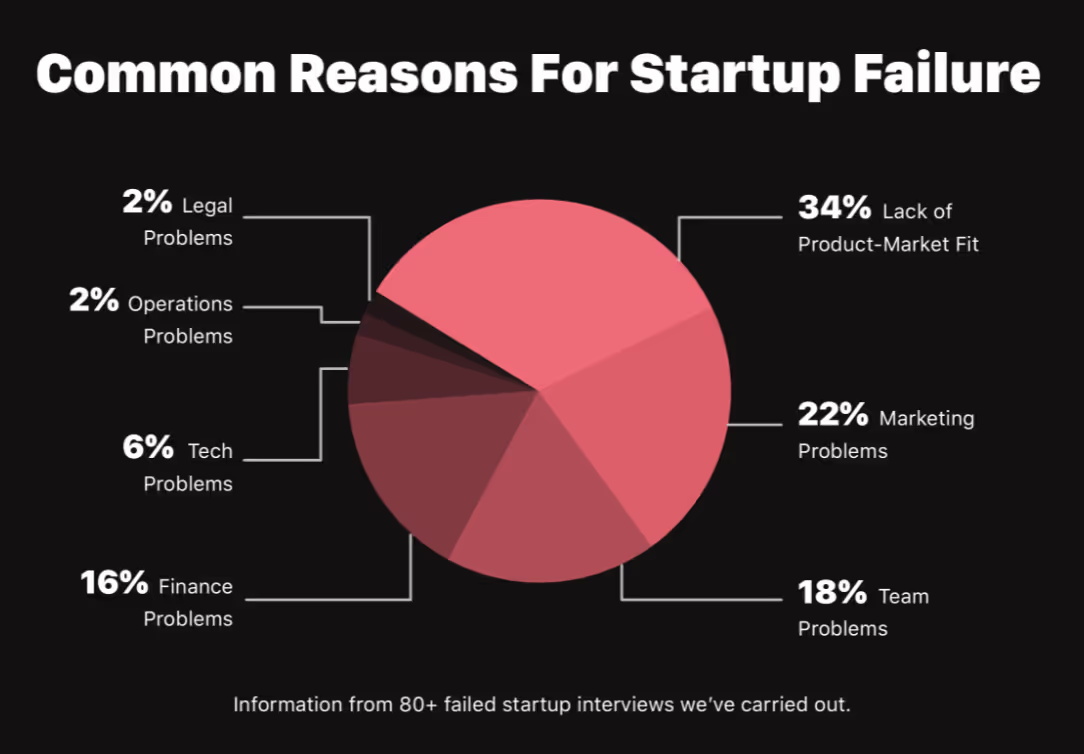

Looking back at Failory's report on why startups fail, we see that the most common reason is a lack of product-market fit (34%).

Note: Product-market fit and market-product fit are interchangeable. While it's just a matter of wording, we prefer the latter because it serves as a reminder that when building a product, everything starts with the market. Not the other way around.

Founders often prioritize creating a product over choosing a market that's in need of a solution. That's a mistake we've seen thousands of times.

- Startups build a product they think is wonderful.

- They never find a market that has a need for it.

Even well-funded startups can crash if they don't consider the market they're selling to before building a product.

Take Quibi, for example. The mobile-only streaming service raised nearly $2 billion (yes, with a B) but shut down only seven months after launch.

One of the primary reasons for this meteoric failure was a lack of market-product fit. The target market—people with smartphones who watch content—was massive, and yet Quibi was only able to acquire about 72,000 paying customers.

Why? Because the problem they were looking to solve wasn't severe enough for users to switch to Quibi from YouTube or TikTok, where they could watch videos for free.

Conversely, the media startup Patreon was able to build a product that their target market—YouTubers who need to find ways to monetize their content—found valuable from day one. Patreon's founders were creators themselves. They intimately understood the problem they were trying to solve and whom they were solving it for. These market insights were based on feedback from real users and the market—not assumptions.

Patreon started with the market. They didn't build a product and then start searching for customers.

Market-model fit

Definition: how your market fits with your product’s business model

Your market will also dictate your pricing and business model, and vice versa.

There are two major business-model factors we like to focus on:

- How much you charge: What is the lifetime value or average revenue per year each customer generates?

- How and when you charge: Do you charge a monthly subscription? Do charge a one-time, upfront payment? Or do you offer a free trial or freemium option?

Then there are a few key market-model factors:

- Market size: How many potential buyers are in your market?

- Buying power: How much is an individual within your market able to spend?

- Willingness to pay: How motivated are they to spend?

Inevitably, your business model will cause friction between your business and your customers. Your goal is to minimize that friction.

How much you charge & market size

First, we need to look at the relationship between how much you charge and the size of your market. If your goal is to build a massive company, you're unlikely to succeed if you're targeting a small market and charging a small amount.

This diagram from founder and investor Christoph Janz demonstrates our point. There's a tradeoff between the number of customers you need to acquire and the price you're able to charge.

If you have a small market size AND low average annual revenue per customer, that's a market-model fit issue (especially if your goal is to build a large company). This seems like an obvious concept, but it's something startups often get wrong. That's likely because they think their market is bigger than it really is, and/or they think they'll be able to charge more than they really can.

Buying power & willingness to pay

Another critical concept: The relationship between your market's buying power/willingness to pay and how much you charge. Your market may desperately want your product, but if they simply don't have the budget, then nothing else matters. You must adapt your model for your market's buying power.

On the flip side, you may be targeting a market with deep pockets, but it's their willingness to pay that will determine how much you can actually charge. How much do they need and value your product?

How and when you charge

Finally, how you charge your customers is important. Some products are totally free to use (Twitter); others offer a freemium plan (Grammarly and Spotify); some offer monthly or annual subscriptions (Netflix); and some require big one-time payments (buying a car). Each model has its own level of friction.

The lower the buying power and willingness to pay, the more friction you'll create by requiring big, upfront payments. You'd likely find more success by lowering your prices, while simultaneously using a low-friction model like freemium or subscription.

Alternatively, if your market does have high buying power and willingness to pay, you can employ a higher-friction model, such as six-figure annual contracts or big one-time payments.

Market-brand fit

Definition: how your market fits with your product’s brand

A "market" is a group of individuals who have certain commonalities.

A strong brand appeals to those commonalities.

We define "brand" as how you communicate with your market. This includes colors, typography, design style, imagery, and the language you use.

Sure, you make the creative decisions. But your brand is ultimately your market's perception of your startup. What do your brand elements, and your brand as a whole, make people think—and feel?

Those kinds of connotations can be extremely powerful. Think about your own favorite brand. Why do you like it? Chances are, the number one reason is that you love the product. But right below that, you may realize how much you love the brand. And maybe the brand is what made you want to use the product in the first place. Maybe you felt a special connection with it because of how it looked and sounded.

(This thought exercise applies to music too. Sure, you might love Beyoncé’s music [her product] but for most people, it’s who she is and what she stands for [her brand] that lead to Beyhive membership. Her market loves her brand.)

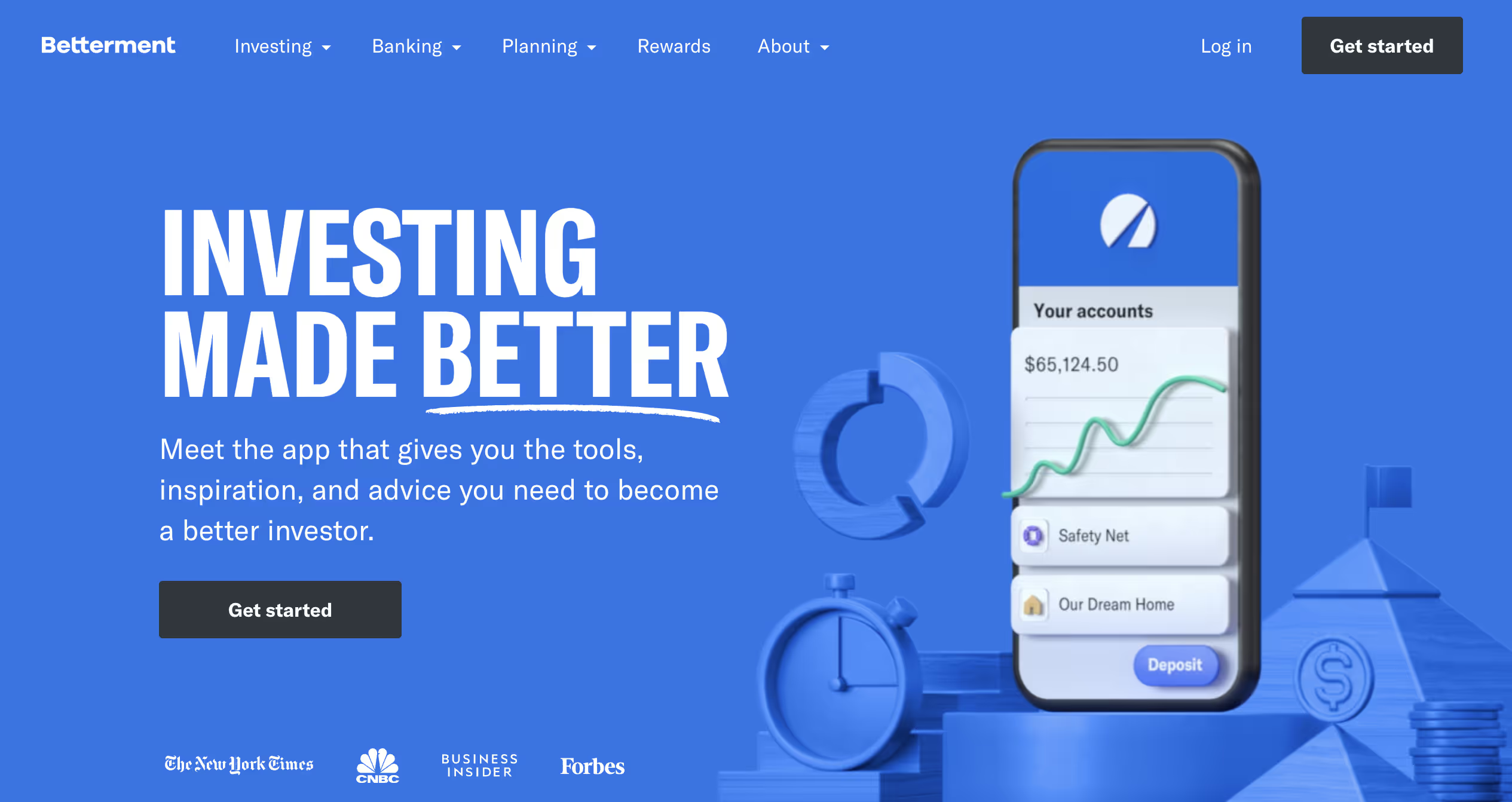

Example of market-brand fit: Betterment

Let's look at how Betterment, an investing and savings app, was able to find market-brand fit. We'll focus on the language they use in their communications and marketing.

Betterment had to overcome a key emotional hurdle: People are intimidated by personal finance. They're skeptical of companies trying to manage their money.

So they were intentional in how they crafted their messaging. They kept it professional and friendly, using approachable language like "meet the app" and "inspiration."

If Betterment's brand were silly, unprofessional, or unfocused, they'd have a hard time winning the trust of their market.

Brand and other fits

Your brand needs to align with your market. But it's also critical that your brand align with the other three components:

- Brand-model fit: E.g., Mercedes-Benz is a premium brand. They don't sell cars for $15k. If your brand is highly exclusive, your business model shouldn't diminish that exclusive nature.

- Brand-product: Your product experience is an extension of your brand. How your product looks and works influences your brand perception.

- Brand-channel: Your brand could determine how you approach certain channels, and it could even help you rule out channels. If you operate in a very serious industry like cybersecurity, you might want to avoid informal channels like TikTok or Snapchat. If your brand is family-oriented, there are many "adult" placements you wouldn't want your brand seen on. And if your brand is all about sustainability, you might rule out resource-intensive channels like direct mail.

As you can see, brand touches every aspect of your business. We recommend starting with finding market-brand fit, then allowing your learnings to shape how you approach the other brand fits.

Market-channel fit

Definition: how your market fits with your customer acquisition channels

Your market will influence which channels you pursue.

As we discussed in the market-brand fit section, your market will have expectations depending on the industry and product category.

If you're selling payroll software to municipalities with over a million citizens, you have a very small market to sell to: the purchasing department and financiers of select cities. It would make little sense, from a communications standpoint, to try to reach those people using Snapchat ads.

Why? Two main reasons:

- The channel isn't targeted enough: Snapchat will allow you to target your ads to specific locations, but it won't allow you to target the specific employees of a city. This means that if you run Snapchat ads, most viewers will fall outside your target market.

- The channel context doesn't align: It's possible that your target market has Snapchat, but that's definitely not the channel they expect (or want) to see work-related content on. Seeing an ad for payroll software on a non-business app might make them hesitate to trust your brand with something as serious as payroll.

Just because a channel exists doesn't mean you need to use it. That's why it's so important to truly understand your market. Deep customer research will uncover key insights such as where potential customers spend time offline and online, how they purchase products like yours, their buying intent on various channels, and other channel-related clues.

Having these insights allows you to identify optimal channels, cut the rest, and hone your messaging to each specific channel. We'll show you exactly how to do that in later modules.

Product-channel fit

Definition: how your product fits with your customer acquisition channels

The product you sell must also align with the channel you sell it through.

Let's continue our payroll software example from the last section. Because your market is small, you'll need to charge a lot for your product to generate revenue and grow. In order to charge a lot, your product must be robust. Your sales cycle will be pretty complex, as the buyer is going to need to make sure your product is perfect for them before signing off on a large purchase.

Because the product is expensive and the sales cycle is complex, you'll need to choose an acquisition channel that allows you to communicate product information effectively with your target market.

In this example, a channel like Facebook ads wouldn't allow you to convince your buyer to make a large purchase. Users are scrolling too quickly and absorbing too little information for such a complex product. Direct sales would probably make the most sense.

As a rule of thumb: The more complex your product, the more direct and hands-on your acquisition channel needs to be.

The other important thing to consider as you find your product-channel fit is that channels are usually out of your direct control. Google's SEO algorithm changes, and the price of ads fluctuates.

What is in your control is your product. So it's smart to build your product for the specific channel(s) you want to leverage. Since channels aren't in your control, you must be able to adjust your product over time to work with your chosen growth channels.

Model-channel fit

Definition: how your business model fits with your customer acquisition channels

Your business model will limit the acquisition channels that are worth testing.

Let's say you charge $100,000 up front for your product. That's a lot of money, and it will require extensive communication with a prospective customer to close the deal. Your customer isn't going to feel comfortable paying you $100,000 after seeing a few ads and reading the FAQs page on your site. You need a more context-rich channel, like sales.

Luckily, with such a high contract value, you'll be able to afford such an expensive channel. Your model-channel fit will be strong.

Here're a couple of other rules to consider:

- The more expensive your product, the more direct and hands-on your acquisition channel needs to be. You’ll likely need multiple touchpoints to communicate the value of your product and get customers over the high price point.

- The more friction there is in your product, the more hands-on your channel needs to be. Low-cost channels like virality can work for free products because there’s virtually no friction—there’s no cost to use the product. Complex, high-friction products—like most B2B tools—will require higher-touch, context-rich channels like content and sales.

You should also pay attention to the unit economics when considering your model-channel fit. The cost of acquiring a customer will vary drastically based on your channel:

- Product virality has a very low cost.

- Content marketing is typically next in line.

- Paid marketing comes next.

- Then sales.

Note: Sales can be broken down into two sub-categories: inbound sales and outbound sales. With inbound, you pair sales with a second channel lane—usually content or paid marketing. The secondary channel produces your lead gen while your inbound sales team turns those leads into customers. Outbound sales relies on your sales team to produce both lead gen and the conversion of those leads. On our cost spectrum, inbound sales is generally lower-cost than outbound.

To drive growth profitably at scale, you must have a business model that produces significantly more revenue than the cost of your channel.

For example, an ecommerce store whose average customer spends only $30/year will struggle to afford to acquire customers through ads. It will likely cost more than $30 to acquire each new customer. Similarly, a B2B company with an average customer value of $500 will struggle to make outbound sales work. Since sales labor isn't cheap, it usually costs more than $500 to close a B2B sale.

The five fits summary

There's no such thing as a "perfect fit." It's not fixed, and it's not something you ever "finish." Markets are always changing, products come and go, and channels are constantly in flux.

Our job as startup and growth leaders is to design foundations using these fits as our guiding light and then consistently optimize the fits as we experiment and learn.

We put a lot of emphasis on the five fits because they set the stage for what really matters when it comes to growth. Far too many people get caught up in channel strategy, tactics, and A/B testing. None of this matters if your foundation is broken. And yet, all those things will be significantly more effective if your foundation is strong.

This framework is a shortcut for figuring out which marketing channels you should pursue. When you're just starting to think about customer acquisition, there are seemingly endless channels and tactics to consider. But once you start thinking about your strategy through the lens of the five fits, it becomes clear that there are actually very few ways to approach customer acquisition—and you'll be able to confidently ignore the rest.